Trading is a vast industry, and there was a time when only a limited number of entities managed them. Traders needed to go through banks or intermediaries to trade in the market. However, the introduction of decentralized exchanges (DEXs) in blockchain solutions in 2017 made it more of a choice than a necessity.

Some of you might be privy to the concept of flash loans and arbitrage flash loan bots. It has recently sparked interest in several businessmen, traders, and web3 entrepreneurs, as blockchain solutions have a huge role to play in Web3, and for the right reasons. To learn more about them and how you can leverage the technology, keep reading.

What are Flash Loan Arbitrage Bots?

Flash Loan Arbitrage Bots are automated programs made to exploit temporary price discrepancies between different crypto exchanges or platforms in the Decentralized Finance (DeFi) space. They are a part of blockchain solutions that can truly change the way businesses operate.

They use a unique process known as flash loans to execute arbitrage strategies without requiring any upfront capital.

How do Flash Loan Arbitrage Bots work?

Finding the right opportunity

The bot continuously scans various exchanges and platforms, searching for assets with different prices. It can occur due to due to temporary inefficiencies, liquidity issues, or even deliberate price manipulation.

Borrow funds without worrying about collateral

The bot then leverages "flash loans" to borrow a large amount of the undervalued asset from a lending pool. In this transaction, there is no need for collateral.

Arbitrage Execution

The bot uses the borrowed asset to quickly buy it on the exchange at a lower price and sells it on the platform where it is more expensive. This generates a profit due to the price difference.

Loan Repayment

The entire procedure, from borrowing to repaying the loan, happens within a single blockchain transaction. This ensures that the bot doesn't have to hold onto the borrowed asset for any longer than necessary, minimizing risk.

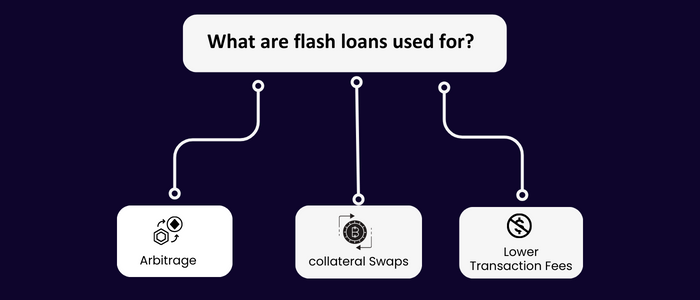

What Function do Flash loan arbitrage bots serve?

Now that you understand how the flash loan arbitrage bots work Let's dwell into the primary functions of the DeFi ecosystem:

1. Price Discovery and Efficiency

The bots identify and exploit price discrepancies across different exchanges, contributing to price discovery. The bots buy low assets on the exchange where prices are low. Then, they sell on platforms where the prices are higher. Subsequently, they help push prices toward a more unified market value. This process enhances the overall efficiency of the DeFi market by reducing price disparities.

2. Profit Generation

Of course, the primary incentive for using flash loan arbitrage bots is profit generation. By capitalizing on temporary price inefficiencies, these bots can generate returns for their operators. This can be attractive to experienced DeFi users seeking additional ways to earn a yield on their crypto holdings.

It is important to note that while bots contribute to market efficiency, they may also exacerbate short-term volatility due to their rapid trading activity. Additionally, the potential for profit generation comes with inherent risks, such as flash loan failures, smart contract vulnerabilities, and rapid market fluctuations.

Therefore, while flash loan arbitrage bots play a role in the DeFi ecosystem, it's crucial to understand both their benefits and limitations before engaging with them.

What are the Benefits of Using the Flash Loan Arbitrage Bots?

Every tool you can find online or otherwise will come with some advantages and disadvantages. Flash load arbitrage bots are no different. They offer a range of benefits, which are listed below:

High-Profit Potential

By exploiting fleeting price discrepancies between exchanges, bots can generate significant profits for their users. It has the potential to provide much higher returns can compared to traditional arbitrage strategies due to the leverage provided by flash loans.

Low Capital Requirement

Unlike traditional arbitrage, which requires upfront investment, flash loans allow bots to access large sums of capital without locking in personal funds. This opens up opportunities for individuals with limited capital to participate in potentially lucrative ventures.

24/7 Automation

Bots operate tirelessly, scanning for profitable opportunities around the clock. This eliminates the need for manual monitoring and intervention, allowing users to passively benefit from market inefficiencies.

Market Efficiency

As bots exploit price discrepancies, they contribute to pushing prices toward a more unified market value across different platforms. This improves the overall efficiency of the DeFi market by reducing arbitrage opportunities.

Liquidity Provision

In some cases, bot activity can increase liquidity on exchanges, which can benefit other market participants by improving trade execution and reducing slippage.

Advanced Strategies

Experienced developers can create bots with complex algorithms that can execute multi-step arbitrage strategies involving multiple assets and platforms, potentially leading to even higher profits.

What Risks Are You Taking by Using Flash Loan Arbitrage Bots?

However, it's crucial to remember that these benefits come with significant risks:

Flash Loan Failure

If the bot cannot repay the borrowed funds within the transaction, the user may face significant financial losses.

Smart Contract Vulnerabilities

Bots rely on smart contracts, which can be susceptible to exploits and hacks.

Rapid Market Fluctuations

Volatile markets can lead to unexpected losses if the bot cannot adapt quickly enough.

Technical Complexity

Setting up and operating flash loan arbitrage bots requires a deep understanding of DeFi protocols, smart contracts, and coding skills.

Regulatory Uncertainty

The regulatory landscape surrounding DeFi is still new, and future regulations could impact the legality and viability of bots.

Therefore, while Flash Loan Arbitrage Bots offer potential benefits, they are not suitable for everyone. Thorough research, risk management, and a strong understanding of DeFi are essential before using these tools.

What are the Alternatives to Flash Loan Arbitrage Bots?

Of course, there are alternatives to using flash loan arbitrage bots.

Traditional arbitrage

Manual trading strategies can achieve similar results, though with less automation and potentially lower returns.

Investing in DeFi projects

Investing directly in DeFi projects offering various yield-generating opportunities can be a less risky alternative.

Why Choose MoogleLabs Services as Your Crypto Arbitrage Bot Development Company?

MoogleLabs is the top crypto trading bot development company. We make advanced arbitrage bots allowing businesses to make secondary income using cryptocurrency trading. These bots can trade automatically on different exchanges to utilize price differences for significant profit.

As the leading crypto arbitrage bot development company, MoogleLabs specializes in creating cutting-edge crypto arbitrage bot for optimal trading profits. They are equipped with advanced features and functionalities that cannot be found anywhere else, ultimately improving your trading profit margins These bots are crafted to follow the highest tech norms and have enhanced security standard for unparalleled performance.

Additionally, we offer:

- 24/7 Support

- Timely Delivery

- Agile Methodology

- Proficient Developers

- State-of-the-art Solutions

Get Your Free Consultation Today!

How to Leverage Flash Loan Arbitrage Bots Responsibly

While crypto flash loan arbitrage bots promise high profits and are not illegal, it's crucial to understand that they can be extremely risky and complex. Here's a reality check:

Before you jump in

- Understand the risks: Flash loans involve borrowing large sums without collateral, amplifying potential losses. Bugs in your bot or sudden market shifts can wipe you out.

- Get expert help: Building and using bots requires deep knowledge of smart contracts, blockchain, and DeFi. Consider professional guidance to avoid costly mistakes.

- Start small: If you still want to try, test with tiny amounts first to minimize potential losses.

Countries like the USA encourage arbitrage trading. On the other hand, countries like India do consider arbitrage trading legal, but with a catch. As per SEBI, you are not allowed to buy and sell the same company’s stock on the same day on different exchanges. So, clearly, there are some limitations.

Depending on your location, the laws can be different. Therefore, it is a must for you to do your due diligence before making any decisions about arbitrage trading.

The simplified steps (but remember the risks!)

- Learn about flash loans: These are uncollateralized loans within a single transaction.

- Choose a platform: Popular options include Aave, Uniswap, dYdX.

- Build or buy a bot: This requires significant expertise. Ensure proper risk management.

- Find arbitrage opportunities: Look for price differences between exchanges for the same asset.

- Initiate the flash loan: Specify the amount and prepare for repayment within the transaction.

- Execute the trade: Use the borrowed funds to buy low and sell high on different exchanges.

- Repay the loan: The bot automatically repays the loan plus fees within the transaction.

- Hope for profit: If successful, you keep the difference after fees.

Remember

- Flash loans are highly risky: Proceed with extreme caution and only if you fully understand the implications.

- Regulations may change: Governments globally are trying to manage the changing landscape of blockchain technology responsibly, which means there is a chance that these bots can become restricted or even illegal in the future.

Do your research, seek professional advice, and start small if you choose to proceed. But be prepared for the significant risks involved.

When used correctly, flash loan arbitrage bots can give you automated, risk-minimized, and highly profitable trading advantage. At MoogleLabs, we have created a flash loan arbitrage bot that makes sophisticated trading strategies accessible to both seasoned and novice traders.

Whether you're looking to diversify your portfolio or maximize your profits, you can get in touch with us to unlock the full potential of decentralized finance.

Building Flash Loan Arbitrage Bots

For people who want to leverage the technology, you will need experts in the latest blockchain solutions programming languages who can create the product. All you need to do is find the right team and let them handle it. Here, we are mentioning the various steps involved in the process:

- Define the goals

- Select the right tech stack

- Develop smart contracts

- Run security audits

- Manage deployment and infrastructure

- Manage the liquidity pool

- Create a monitor and alert system

- Compliance reporting

- Work on testing and simulation

The future of arbitrage bots is extremely promising because bots are now becoming smarter and more efficient thanks to the significant advancements in the use of AI and machine learning.

Breathe a New Life into Your Trading Journey with Flash Loan Arbitrage Bots Blockchain Solutions

Flash loan arbitrage bots can become an exceptional tool in your journey of creating better trading systems for all. It is among the crypto trading opportunities in blockchain consulting solutions that you should not miss out on.

Invest in these bots to capitalize on market inefficiencies and execute trades quickly to get never-seen-before returns. Visit our website to learn more.